About Bourse de Casablanca

Bourse de Casablanca is a public limited company with private capital which operates within the framework of a concession granted by the Moroccan government, in accordance with specifications approved by decision of the Minister of Finance.

Our latest publications

Browse all publications of the Casablanca Stock Exchange

ConsultOur Strategy and Vision

With the aim of breathing new life into the stock market and helping to build a more attractive financial center, Bourse de Casablanca's Roadmap sets out to build a new market architecture designed to make it an integrated African financial hub. The goal is to facilitate access to capital and meet the needs of international issuers and investors.

With the support of all the stakeholders (supervisory authority, regulators and market professionals), Bourse de Casablanca is following three main development lines:

Aim 1

To build an efficient infrastructure through the transformation of Bourse de Casablanca into a stock exchange group, the establishment of a clearing house and a company managing the futures market and the use of a resilient, multi-product technological platform with integrated risk management.

Aim 2

To better contribute to the financing of the economy by stimulating the offer of paper on the ""Equity"" and ""Bond"" markets, reinforcing the attractiveness of Bourse de Casablanca to local and international investors and accelerating the development of the market liquidity.

Aim 3

To expand international reach with the listing of foreign securities, improved connectivity with international financial markets and the creation of a 100% African fund.

Relive the history of Bourse de Casablanca

Created in 1929 as a clearing office, the status and organization of Bourse de Casablanca have undergone several structural reforms. As such, in 1995, a management company was instituted to which the management of the Stock Exchange was conceded, in application of a schedule of conditions approved by the Minister in charge of Finance.

This overhaul of the status of the Stock Exchange is part of a global approach to modernize the financial market, initiated in 1993, and which set among its objectives to provide the Stock Exchange with an organizational structure and modern means in order to strengthen its role in financing the economy.

In 2016, the last Law 19-14 relating to the Stock Exchange, brokerage companies and investment advisers, came to modernize the legislative framework governing the stock market with a better organization of markets and compartments with in particular a so-called alternative market dedicated to SMEs with adapted and lightened access and reporting conditions.

2017

Implementation of the notion of market and compartment with the establishment of an alternative market.

2016

Migration of the NSC quotation system to Millennium Exchange and implementation of a Millennium Surveillance tool from LSEG Technology. Demutualization of Bourse de Casablanca, with a Board of Directors made up of insurance banks, stock exchange companies, CDG, CFC and two independent directors.

2009

Effective transition of Bourse de Casablanca to new mode of governance with Board of Directors and General Management.

2002

Adoption of the performance guarantee system

2000

Bourse de Casablanca Company "SBVC" changes its name to Bourse de Casablanca, a public limited company with a Board of Directors and Supervisory Board

1998

Establishment of the central depository, Maroclear, set up by the enactment of Law No. 35-96 -Shift from open outcry quotation to electronic quotation on the NSC system

1993

A main reform of the stock market has been undertaken to complete and reinforce the achievements with the enactment of three founding texts: the dahir enacting law n°1-93-211 relating to the Stock Exchange (SBVC); the dahir enacting law n°1-93-212 relating to CDVM and to the information required from legal entities making an appeal to the public; the dahir carrying law n°1-93-213 relating to OPCVMs

1967

Establishment of the Stock Exchange as a public institution by Royal Decree, granting it a legal and technical organization.

1948

The Office de Compensation des Valeurs Mobilières becomes the Office de Cotation des Valeurs Mobilières (Office for the Quotation of Securities)

1929

Founding of Bourse de Casablanca, under the name of Office de Compensation des Valeurs Mobilières (Office of Compensation of Securities)

Our governance

Bourse de Casablanca is a public limited company with a Board of Directors and General Management.

Mr. Brahim BENJELLOUN TOUIMI is the Chairman of the Board of Directors since October 14, 2024.

Mr. Tarik SENHAJI has held the position of Managing Director since April 2020.

On June 17, 2016, the demutualization process of the Casablanca Stock Exchange was completed and new Board members were appointed.

The Board of Directors of Bourse de Casablanca is composed of 12 directors, including 2 independent ones.

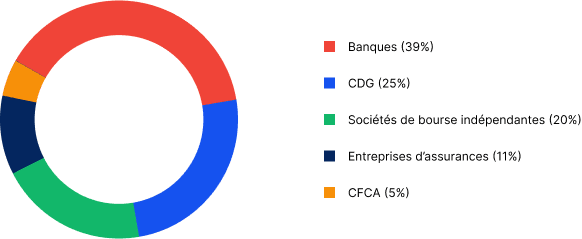

Shareholding

Since June 2016, the share capital of Bourse de Casablanca is 387,517,900 MAD.

International cooperation

Bourse de Casablanca is a member of the following international organizations:

Learn more

Our CSR policy

Bourse de Casablanca is socially responsible

Bourse de Casablanca has integrated social responsibility (CSR) into its strategic development plan since several years and in many fields. The granting of the CSR Label by the CGEM in 2013 and its renewal in 2017 and 2020 is a real recognition that confirms that the CSR approach fits perfectly into the company's global development strategy, through a CSR policy materialized by concrete actions.

Learn more

Bourse de Casablanca, a people-centered company

Bourse de Casablanca's new HR policy has provided a human resources management framework capable of achieving strategic objectives and achieving performance targets.

Customer satisfaction, performance improvement, motivation and commitment of its employees together with the fostering of young talents constitute the major stakes of its HR Policy.

To learn more about this CSR approach, consult our CSR report.

We are Our Values

The women and men of Bourse Casablanca promote, on a daily basis, an image of a successful, transparent company committed to the economic growth of Morocco in compliance with the regulations in force.

Demonstrate professionalism and respect for colleagues and stakeholders, acting conscientiously, in accordance with internal and external guidelines/procedures, and adopting caring and impartial attitudes.

Acting with a major concern to be at the service of internal and external customers, to satisfy them and generate value for them by ensuring that mutual commitments are respected.

Act with passion, enthusiasm, and benevolence in the face of demands and constraints. Meet challenges with determination in a collaborative and cooperative manner.

Proud to be in Join One Team

Bourse de Casablanca does its utmost to ensure that its employees develop fully and contribute to the company's development.

Proximity, supervision, learning, career management: a wide range of means are made available to them to help them grow in their functions.

Bourse de Casablanca favors a corporate culture based on strong customer orientation and management through trust and responsibility.

Joining the One Team of Bourse de Casablanca is choosing the path of excellence.

Certifications

ISO 27001 Certification

Secure information systems : The certification ISO 27001 for of the Casablanca Stock Exchange has been renewed.

ISO 27001 certification for secure information systems of the Casablanca Stock Exchange has been renewed. In line with its objective to adopt the best international standards, Bourse de Casablanca has, for several years now, undertaken measures to step up the governance, reliability and performance of its Information Security Management System (ISMS).

The ISO 27 001 standard identifies the requirements for setting up the ISMS, to outline the security measures to be applied to ensure the protection of a company’s sensitive information and assets within the defined scope.

ISO 9001 Certification

The Casablanca Stock Exchange succeeded in the renewal of ISO 9001 version 2015 certification as a result of the audit conducted by Bureau Veritas certification, that confirmed the absence of any “non compliance”.

The scope of this certification covered the three fundamental components of the Casablanca Stock Exchange mission: the operations as well as the development and promotion of the Moroccan stock market

The ISO 9001 version 2015 certification was renewed for 3 years.

About Us

Ecosystem

©2023 Casablanca Stock Exchange - All rights reserved

Made by VOID