Why Go Public ?

Raise Capital

- Benefit from advantageous financing, without the need for collateral and at a lower cost, adapted to your company's projects;

- Diversify and optimize your future fundraising;

- Permanently evaluate your business and benefit from immediate liquidity.

Boost your company's growth

- Develop your business and your products, attract new customers and explore new markets;

- Strengthen your capital to boost your expansion projects in Morocco and internationally;

- Attract quality investors ready to support your growth projects over the long term.

Sustain your business

- Give your company the label of good governance of world-renowned reputation;

- Guarantee a smooth transmission and institutionalize your business;

- Improve the image and reputation of your company with your customers, suppliers, employees and partners.

Listed companies attest ...

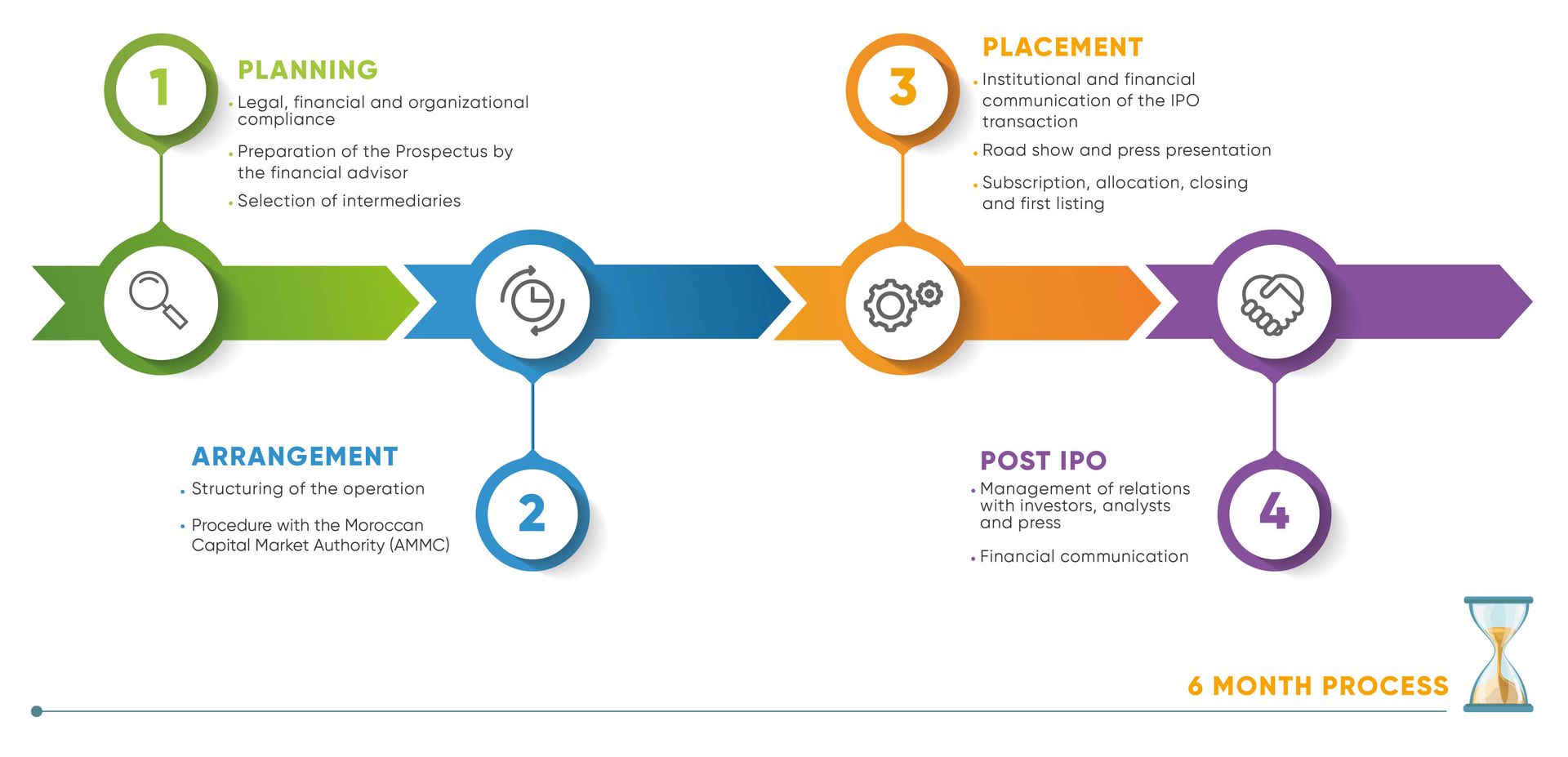

IPO process

Le choix du marché de cotation

The Main Market

- Take advantage of a strong demand from national and international professional and institutional investors.

- Benefit from an attractive valuation and an immediate liquidity.

- Adopt the best international standards of communication and governance.

The alternative market

- Benefit from an easier access to the stock market (minimum raising of 5 million Dirhams, only 1 certified fiscal year, etc.).

- Use a simplified IPO process adapted to small and medium-sized companies.

- Meet streamlined governance, information and communication requirements.

Does my company classify as an SME?

Did you know

A reduction of the rate Corporate of income tax of 50% during 3 consecutive years is granted to the companies which introduce their securities in the stock exchange by increase of capital of at least 20% with abandonment of the preferential subscription right, intended to be diffused in the public.

A reduction of the rate of Corporate income tax of 25% during 3 consecutive years is granted to the companies which introduce their securities in the stock exchange by opening their capital to the public and this, by the transfer of existing shares.

The "Offre PME" is an initiative jointly carried out by the Moroccan Capital Market Authority, the Casablanca Stock Exchange, Maroclear and the Professional Association of Stock Exchange Companies (APSB). Its main goal is to address the concrete problems faced by SMEs wishing to finance themselves via the capital market. It is articulated around 3 components:

- A reduction of 50% of the introduction fees to the Alternative Market of the Casablanca Stock Exchange ;

- The establishment of a single desk to optimize market access procedures;

- The establishment of a training and support system for SMEs.

Latest transactions on the stock exchange

Casablanca Stock Exchange in numbers at the end of 2022

0MMdhs

Capitalization Stock market

0

Listed Companies

0%

Availability Trading platform LSEG Technology

They trusted us

The IPO guide

Download the guideDo not hesitate to contact us

About Us

Ecosystem

©2023 Casablanca Stock Exchange - All rights reserved

Made by VOID