Listing Methods

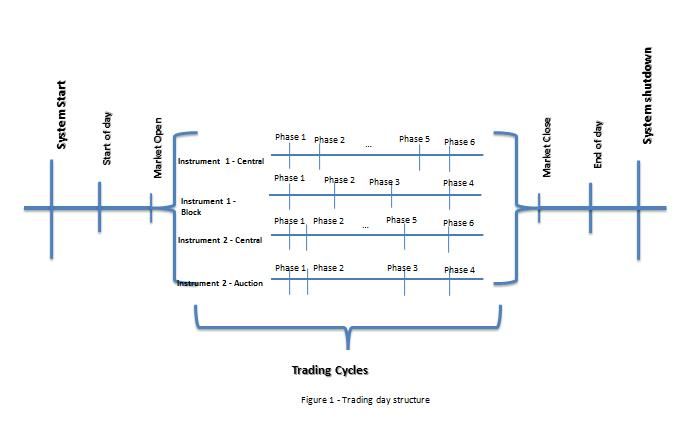

If an instrument is traded on several order books, the Exchange will set a trading cycle (trading session) for each order book, across trading phases authorized for that order book. A trading day, enabling all instruments to be traded in accordance with various order books, is structured as follows:

A trading round consists of a number of consecutive phases. Each phase is carried out according to a timetable defined by the Casablanca Stock Exchange for each Trading Cycle.

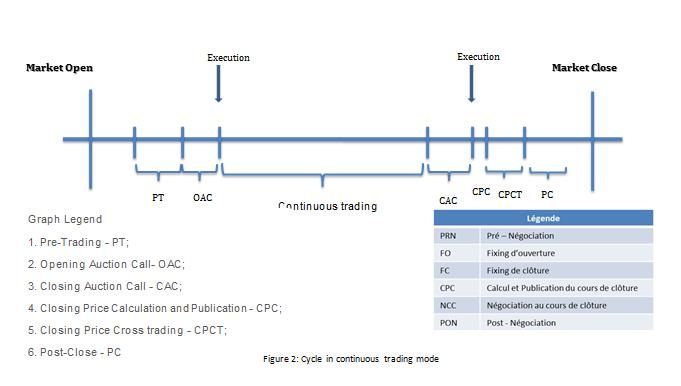

Trading cycles on the central order book:

Financial instruments are traded on the central order book either by continuous matching of orders of opposing sides, following a continuous trading cycle, or by matching orders after a period of build-up without execution, following a fixing trading cycle. Negotiation phases are outlined below:

Scheduled phases:

- Pre-Trading;

- Opening Auction Call;

- Continuous trading (Regular Trading);

- Closing Auction Call;

- Closing Price Calculation and Publication;

- Closing Price Cross trading;

- Post-Close.

Unscheduled phases:

- Re-Opening Auction Call Fixing;

- Halt of Trading;

- Break.

Pre-Trading

First phase of central order book trading cycle, it enables market discovery. Market Oversight can take action in preparation for the session. Active and GTC orders will be present in the order books.

Order entry, modification and cancellation are not permitted.

Opening Auction Call

At this stage, participants forward orders to the market and these are entered in the order books, but do not yet trigger executions. Orders can be modified or cancelled. A theoretical price is calculated and continuously published whenever an order is introduced, modified or cancelled.

At open time, orders in the book are matched for each instrument and, whenever possible, a price is quoted.

Regular Trading

After the open and until the Closing Auction Call, orders are executable continuously, participants can enter, modify or cancel orders. Continuous trading means the matching of all orders as entered in the order book and, if and when possible, transaction execution and instant price setting for each instrument.

Closing Auction Call

At this stage, participants forward orders to the market and these are entered in the order books, but do not yet trigger executions. Orders can be modified or cancelled. A theoretical price is calculated and continuously published whenever an order is introduced, modified or cancelled.

At close time, orders in the book are matched for each instrument and, whenever possible, a price is quoted.

Closing Price Publication

In this phase, order entry and modification is not allowed. It generally lasts one minute and enables the calculation and dissemination of a closing price for each instrument.

Closing Price Cross

This phase follows closing price publication and enables closing price quotation.

Orders are entered and executed at closing price and at that price only. Compatible orders are instantly matched based on Price - Time priority.

Post Close

Last phase of central order book trading cycle, it enables market discovery. Market Oversight can take action in preparation for end of session. Orders can be cancelled.

Re-Opening Auction Call

This unscheduled central order book trading phase occurs when price thresholds are breached. At this stage, participants forward orders to the market and these are entered in the order books, but do not yet trigger executions. Orders can be modified or cancelled. A theoretical price is calculated and continuously published whenever an order is introduced, modified or cancelled.

At reopening time, orders in the book are matched and, whenever possible, trading is resumed and price quoted.

Halt

An instrument is automatically halted upon regular trading hour price threshold violation or initiated by Market Oversight. Order entry and modification are not allowed during this phase.

Break

A pause can only be initiated by Market Oversight. Orders in the book are maintained during this phase. Participants may enter, modify or cancel orders.

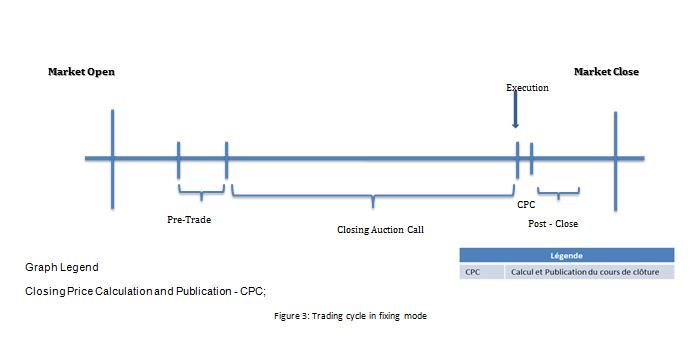

Trading cycles under fixing mode

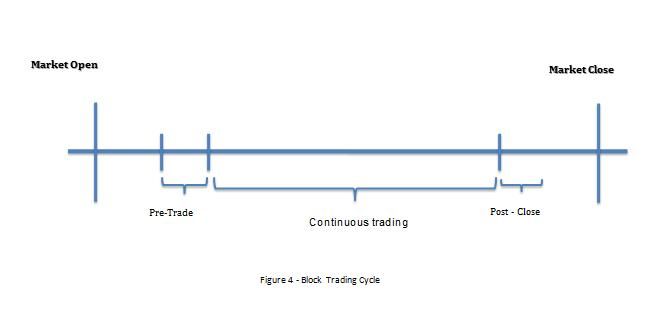

Trading cycle on the block order book

Financial instruments are traded on the block order book by continuous matching of orders of opposing sides in compliance with size and price conditions.

Scheduled phases:

- Pre-Trading;

- Regular Trading;

- Post Close.

Unscheduled phases:

- Halt;

Pre-Trading

First phase of block order trading cycle, it enables market discovery. Market Oversight can take action in preparation for the session. Active and GTC orders will be present in the order books.

Order entry, modification and cancellation are not permitted.

Regular Trading

After Pre-Trading and until Post-Close, orders are executable continuously, participants can enter, modify or cancel orders. Continuous trading means the matching of orders as entered in the book and execution of transactions in accordance with size and price conditions.

Orders placed are shown in the order book according to Price - Time priority.

Post Close

Last phase of block order book trading cycle, it enables market discovery. Market Oversight can take action in preparation for end of session. Orders can be cancelled.

Halt

An instrument is automatically halted upon regular trading hour price threshold violation or initiated by Market Oversight. Order entry and modification are not allowed during this phase.

Break

A pause can only be initiated by Market Oversight. Orders in the book are maintained during this phase. Participants may enter, modify or cancel orders.

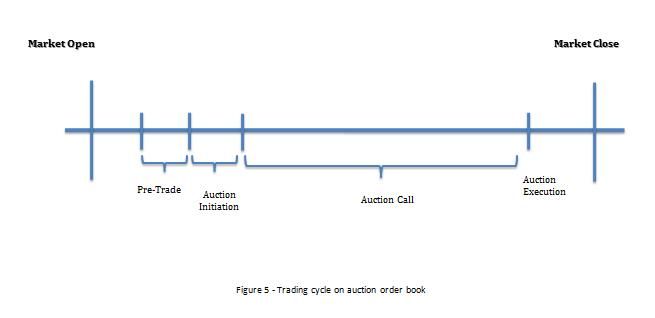

Trading cycle on the auction order book

The auction order book can only be triggered by Market Oversight, its cycle unlike other order books can run over several days.

Scheduled phases:

- Pre Trading;

- Auction Initiation;

- Auction Call;

- Auction Execution.

Unscheduled phases:

- Halt

Pre-Trading

First phase of auction order book trading cycle, it enables market discovery. Market Oversight can take action in preparation for the session.

Auction Initiation

Immediately after Pre-Trading, it enables Market Oversight to enter initiation orders.

Auction Call

At this stage, participants forward orders to the market and these are entered in the order books, but do not yet trigger executions. Orders can be modified or cancelled.

Auction Execution

At execution time, orders from the book are matched and, whenever possible, the auction is executed according to procedures specified in this manual.

Halt

An instrument goes into trading halt at the initiative of Market Oversight. Order entry, modification and cancellation are not permitted during this phase.

About Us

Ecosystem

©2023 Casablanca Stock Exchange - All rights reserved

Made by VOID